Lido stETH Redemption Analysis

🔎A comprehensive analytical report on the Lido StETH redemption rush, focusing on the key factors, implications, and trends observed during the event.

💥 Overview of the Lido protocol

Lido is a Decentralised Autonomous Organization (DAO) and Liquid Staking protocol which arose in the days prior to Ethereum’s famous “Merge” when staking first went into play within the Ethereum ecosystem. Lido solved the problem of Ethereum’s 32 ETH staking requirement, and also lets users access the locked value of their staked tokens through its Liquid Staking innovation. Liquid Staking lets Lido users keep the liquidity of their staked tokens by using a stand-in stToken which can be used to earn additional yield through Decentralised Finance (DeFi) market participation.[1]

Recently, Lido Finance enabled withdrawals of Ethereum (ETH) in the form of staked Ethereum 2.0 tokens (stETH). This feature attracted significant attention and led to an impressive rush of stETH redemptions. In this dashboard, I will provide an analytical report on the Lido stETH redemption rush, focusing on the key factors, implications, and trends observed during the event.

stETH holders can initiate a withdrawal request. After the requests are made, an oracle will ascertain which Lido operators need exit validator nodes to meet this request. Lido operators will then request a validator exit, submitted to a consensus node on the Ethereum mainnet. Once the specified validators have exited, stETH holders can claim their ETH. Therefore, to extract data related to ETH withdrawal from the Lido platform, we considered two statuses: request and claim. Referring to the Flipside database, we used the tables ethereum.core.ez_eth_transfers and ethereum.core.ez_token_transfers to obtain information about the claim and the request, respectively. We considered the condition ETH_FROM_ADDRESS='0x889edc2edab5f40e902b864ad4d7ade8e412f9b1' to check transactions related to claim. On the other hand, when an address registers a request to withdraw its ETHs during a transaction, its stETHs are sent to the address '0x889edc2edab5f40e902b864ad4d7ade8e412f9b1' and receive an NFT labeled unstETH in return. Therefore, to find the data related to the request transactions**, the condition contract_address='0xae7ab96520de3a18e5e111b5eaab095312d7fe84' and

to_address='0x889edc2edab5f40e902b864ad4d7ade8e412f9b1' are considered. To get information about staking using the table ethereum.core.ez_token_transfers We consider the conditions contract_address = lower('0xae7ab96520DE3A18E5e111B5EaAb095312D7fE84' and from_address = 0x000000000000000000000000000000000'.

The Lido protocol plays a significant role in the decentralized finance (DeFi) ecosystem by providing a solution for Ethereum holders to participate in the Ethereum 2.0 (ETH2) network and earn rewards through staking. Here are the key roles of the Lido protocol in DeFi:

-

ETH2 requires a minimum of 32 ETH to participate as a validator. Lido addresses this barrier by allowing users to pool their ETH together and collectively stake it on the ETH2 network.

-

Lido enhances the accessibility of ETH2 staking by eliminating the need for individual users to meet the minimum ETH requirement and set up and maintain their own validator infrastructure. Instead, users can simply deposit their ETH into the Lido protocol and receive staked Ether (stETH) tokens in return. This enables users with any amount of ETH to participate in staking and earn rewards. Additionally, the stETH tokens are tradable, providing liquidity to ETH holders who wish to retain flexibility and accessibility to their staked assets. By staking their ETH through Lido, users can earn staking rewards on their stETH tokens. Lido automatically compounds these rewards by reinvesting them, maximizing the overall yield for participants. This creates an additional source of income for ETH holders and allows them to benefit from the potential long-term value appreciation of ETH while contributing to the security and operation of the ETH2 network.

-

While ETH2 staking presents potential risks, such as slashing penalties for misbehavior by validators, Lido reduces some of these risks by operating a distributed network of validators.

-

Lido is governed by a DAO, where token holders have the ability to participate in the decision-making process. Through the DAO, Lido token holders can vote on important protocol upgrades, fee structures, risk parameters, and other governance aspects.

-

By providing a user-friendly and secure solution, Lido contributes to the growth and development of the DeFi ecosystem by bridging traditional Ethereum holders with the benefits of ETH2 staking.

💥 stETH Token

The stETH token is a tokenized version of staked ETH. When a user sends ETH into the Lido liquid staking smart contract, the user receives the corresponding amount of stETH tokens. The stETH token represents Lido user’s deposits and the corresponding staking rewards and slashing penalties. The stETH token is a liquid alternative for the staked ETH: it could be transferred, traded, or used in DeFi applications. A user’s balance of stETH tokens corresponds 1 to 1 to an amount of ether a user could withdrawal. stETH tokens also can be used in various decentralized financial products. For instance, stETH could be used as collateral. The higher the rate of stETH adoption in different DeFi applications, the more demand for it there would be.[2]

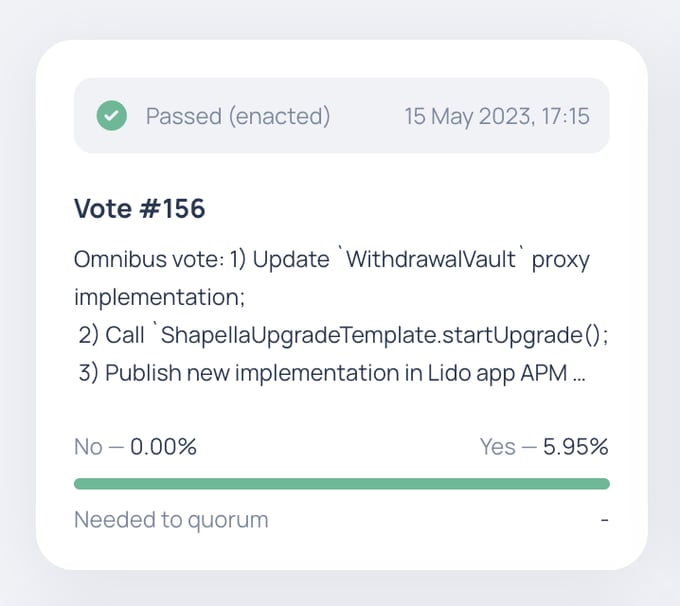

1️⃣ Lido Finance, has upgraded to version 2, a critical change that enables users to withdraw ETH from the platform. The move to version 2 was passed through an on-chain vote with community members deliberating over the proposal. The governance vote number 156, initiated on May 12, was ratified today on the Aragon platform.

2️⃣ The upgrade comes hot on the heels of the Shapella hard fork last month that allowed staking validators to withdraw ETH. Lido V2's pivotal feature enables liquid staking users and holders of staked ether (stETH) to withdraw to ETH from Lido at a 1:1 ratio. This development streamlines the process for individuals to enter and exit Ethereum's liquid staking. The activation of ETH withdrawals on Lido comes a month after Ethereum’s Shapella Upgrade went live.

The liquid staking platform expects the in-protocol ETH withdrawal functionality to streamline the overall staking experience for users and address previous inconveniences related to the protocol’s security. The latest development had led to a bullish impact on Lido’s governance token LidoDAO.